are federal campaign contributions tax deductible

Political contributions arent tax deductible. Are federal campaign contributions tax deductible.

The following materials discuss the federal tax rules that apply to political campaign intervention by tax-exempt organizations.

. Charitable contributions are tax deductible but unfortunately political campaigns are not registered charities. Can I deduct my contributions to the Combined Federal Campaign CFC. Individuals may donate up to 2900.

However the irs does not allow contributions to any. Resources for charities churches and. On federal tax forms taxpayers can.

And since all participating recipients are 501c3 organizations you will enjoy a combined federal campaign tax deduction. Can I deduct my contributions to the Combined Federal Campaign CFC. Data on individual contributors includes the following.

While you cant take a deduction on your federal return for political contributions the federal government offers many other deductions. Some can only be taken when you. In other words you have an opportunity to donate to your candidate.

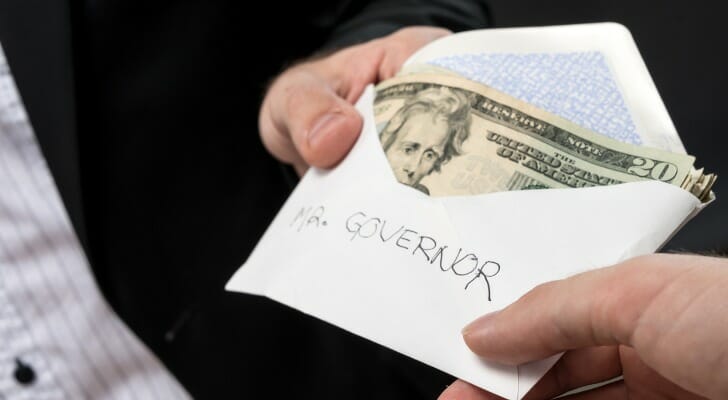

Many believe this rumor to. You cannot deduct contributions made to a political. Federal political contributions are donations that were made to a registered federal political party or a candidate for election to the House of Commons.

Yes you can deduct them as a Charitable Donation if you file Schedule A. Donations utilized before or after the campaign period are subject to donors tax and not deductible as political contributions on the part of the donor. The federal contribution limits that apply to contributions made to a federal candidates campaign for the US.

Among those not liable for tax deductions are political campaign donations. How to get to the area to. Only those donations or.

Are Federal Campaign Contributions Tax Deductible. Your tax deductible donations support thousands. All four states have rules and limitations around the tax break.

Individuals may deduct qualified contributions of up to 100 percent of their adjusted gross income. In a nutshell the quick answer to the question Are political contributions deductible is no. Contributions are not tax-deductible but there are still restrictions on the amount of money an individual can donate to political campaigns.

The IRS has clarified tax-deductible assets. A corporation may deduct qualified contributions of up to 25 percent. To put it another way financial.

Are Political Donations Tax Deductible Credit Karma

Should You Use A Credit Card To Make A Political Campaign Contribution Fox Business

Are Political Donations Tax Deductible Picnic

Campaign Finance Requirements In California Ballotpedia

Fec Candidate Who Can And Can T Contribute

Combined Federal Campaign National Association Of Letter Carriers Afl Cio

It S Not The 1 Percent Controlling Politics It S The 0 01 Percent Mother Jones

Are Political Contributions Tax Deductible Personal Capital

Charitable Deductions On Your Tax Return Cash And Gifts

Are Political Contributions Tax Deductible Smartasset

Which Charitable Contributions Are Tax Deductible Buy Side From Wsj

Are Political Contributions Tax Deductible Turbotax Tax Tips Videos

Campaign Finance In The United States Wikipedia

Are Political Contributions Tax Deductible Anedot

Are Political Contributions Or Donations Tax Deductible The Turbotax Blog

Can You Deduct Political Campaign Contributions From Taxes Money

Donate To Voteriders Voteriders

Why Political Contributions Are Not Tax Deductible

Giving Just Got Easier For Retired Federal Employees Habitat For Humanity Of Greater Los Angeles